The Unseen Risk: When Your Bank Suddenly Says 'No'

It’s Wednesday. Your business bank account is suddenly frozen, flagged for ‘crypto risk.’ Payroll is due Friday. This isn’t a hypothetical nightmare; it’s a real-world scenario that highlights a tangible operational risk for modern businesses. As banks heighten their automated compliance scrutiny, legitimate transactions can trigger false positives, leading to immediate account freezes. These disruptions can unexpectedly halt outgoing payments, jeopardizing not just payroll but also critical vendor relationships and your company's reputation. A single, automated flag can bring your entire financial operation to a standstill with little to no warning.

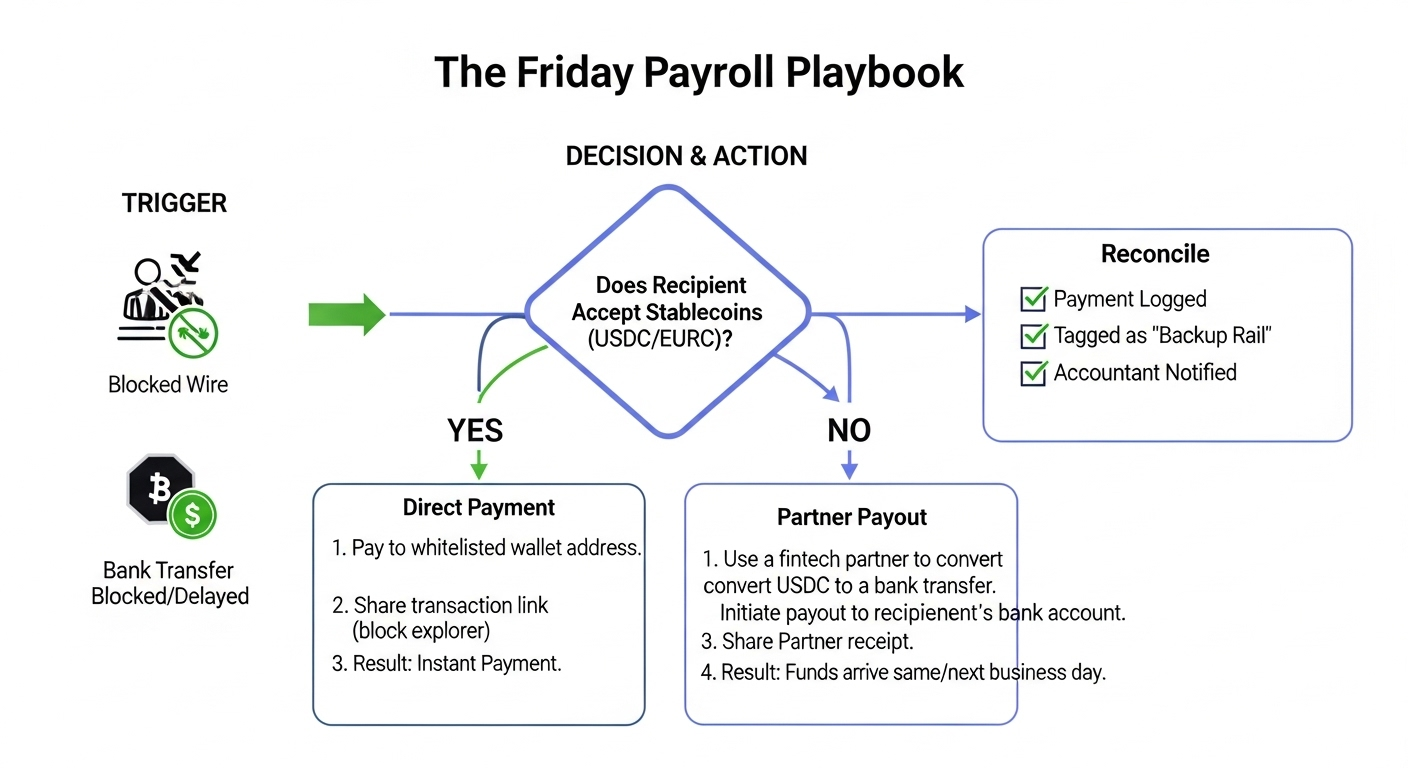

This article cuts through the noise to provide what you need: a concise, jargon-free, and practical backup plan. We will outline a simple yet robust strategy that any business can implement to ensure financial continuity when their primary bank fails them. This is not a theoretical discussion but a real-world playbook designed for immediate action. By following these steps, you can build a resilient financial infrastructure that guarantees you can always meet your most critical payment obligations, turning a potential crisis into a manageable inconvenience.

Your Financial 'Spare Tire': The Digital Dollar Wallet

Think of this solution as a financial spare tire: you don't drive on it daily, but it’s essential for emergencies. The core idea is to establish a parallel payment rail using digital dollars—specifically, 1:1 fiat-backed stablecoins like USDC and EURC, issued by regulated entities such as Circle. Each digital dollar is always redeemable for a traditional dollar or euro, providing stability without the volatility of other crypto assets.

This is a backup system, not a replacement for your primary business bank account. It ensures you can always make critical payments if your main account is frozen. The setup is simple and requires only three components:

- Your Existing Business Bank Account: The primary hub for your day-to-day finances.

- A Business Wallet Account: From a provider that supports USDC and EURC for sending and receiving payments.

- An Operational Float: A small, ring-fenced amount of capital (e.g., 3–7 days of payroll) held as digital dollars in your wallet, ready for immediate deployment.

This structure provides a simple, logical, and instantly accessible backup to keep your business running during a banking disruption.

The One-Time Setup for Payroll Protection

-

Open a Business Wallet. Select a reputable business wallet provider that supports Circle-issued stablecoins like USDC and EURC. Complete the required Know Your Business (KYB) verification to activate your account. This creates your secure, off-bank payment hub.

-

Implement Security Controls. Immediately enable two-factor authentication (2FA) for all account users. Configure a dual-approval workflow (multi-sig) requiring a second authorized person to approve any payment exceeding a set threshold (e.g., $500). This is a critical safeguard against unauthorized transactions.

-

Fund a Small Float. Transfer a capped amount of capital—equivalent to 3–7 days of critical operational expenses—from your bank to your wallet. Convert these funds into USDC or EURC. This is your emergency-only operational reserve, not a primary treasury.

-

Create a Payee Whitelist. Pre-authorize and save the wallet addresses of employees and critical vendors. If your provider allows payouts to bank accounts, add and verify these details as well. Whitelisting prevents payment errors and fraud by restricting sends to pre-approved recipients only.

-

Run a Test Transaction. Send a small amount (e.g., $100) to a trusted recipient to verify the entire workflow, from funding to final settlement. This test confirms your setup is correct and ready for an emergency, ensuring no surprises when you need it most.

Executing the Playbook: A Step-by-Step Guide

When your bank account is frozen on a Friday, execute this four-step playbook immediately.

1. Triage & Communicate First, triage payments. Identify who must be paid today—salaries and critical contractors—and who can wait. Communicate the situation transparently using these templates:

-

Email/Slack to Staff:

- Subject: Payroll Update

- Body: Hi team, we've encountered a temporary disruption with our primary bank. To ensure you are paid on time, we will be sending your salary today via our backup payment system. No action is needed from you. We will provide an update once the issue is resolved. Thanks for your understanding.

-

Email to Contractors:

- Subject: Invoice Payment Update

- Body: Hi [Name], we've encountered a temporary disruption with our primary bank. To ensure your invoice [Invoice #] is paid on time, we will be sending payment today via our backup system. Please confirm receipt. We apologize for any inconvenience.

2. Choose the Payment Rail Next, select your payment method. For recipients who accept digital dollars, send USDC directly from your wallet to theirs for instant settlement. For those requiring traditional bank payments, use your wallet’s integrated payout service to send funds directly to their bank account.

3. Execute & Verify Initiate payments from your pre-approved payee whitelist. For direct USDC sends, provide the recipient with the transaction link from a block explorer (like Etherscan or Polygonscan) as immutable proof of payment. For bank payouts made via a partner service, forward the payment confirmation receipt as verification.

4. Reconcile Finally, reconcile immediately. Record the transaction in your accounting software, tagging it clearly as a "backup rail payment." This maintains a clean audit trail and ensures your books remain accurate during the disruption.

Costs, Safety, and Final Considerations

Understanding the practicalities is key. Compare your payment rails: bank wires are cheap but slow (1-3 days) and limited to business hours. Direct USDC/EURC transfers settle near-instantly, 24/7, for a small network fee. Payouts to bank accounts via a partner service take same-day to 2 days and incur a service fee.

Three safety rules are non-negotiable. First, keep your float small; this is an emergency fund, not a primary treasury. Second, require two-person approval (multi-sig) for any significant payment to prevent unauthorized transactions. Third, run a small test transaction before an emergency to validate your setup.

Do you need to switch banks? Not necessarily. This playbook is designed as a backup, not a full migration. It provides immediate protection and buys you time to resolve the issue with your current bank. However, if account freezes become a recurring problem, you should begin a parallel search for a more crypto-friendly banking partner. This strategy ensures your business remains operational while you find a stable, long-term solution without pressure.