The Weekend Problem: When Bank Hours Halt Your Business

Banks operate on a 9-5, weekday schedule, but business is 24/7. It’s 4:45 PM on a Friday, and you’ve just missed the wire cutoff. This common scenario highlights a critical flaw in modern finance: traditional banking hours create cash flow gaps that can paralyze a business over weekends, holidays, or even overnight. Essential payments are delayed and operational continuity is threatened simply because the banking infrastructure is offline.

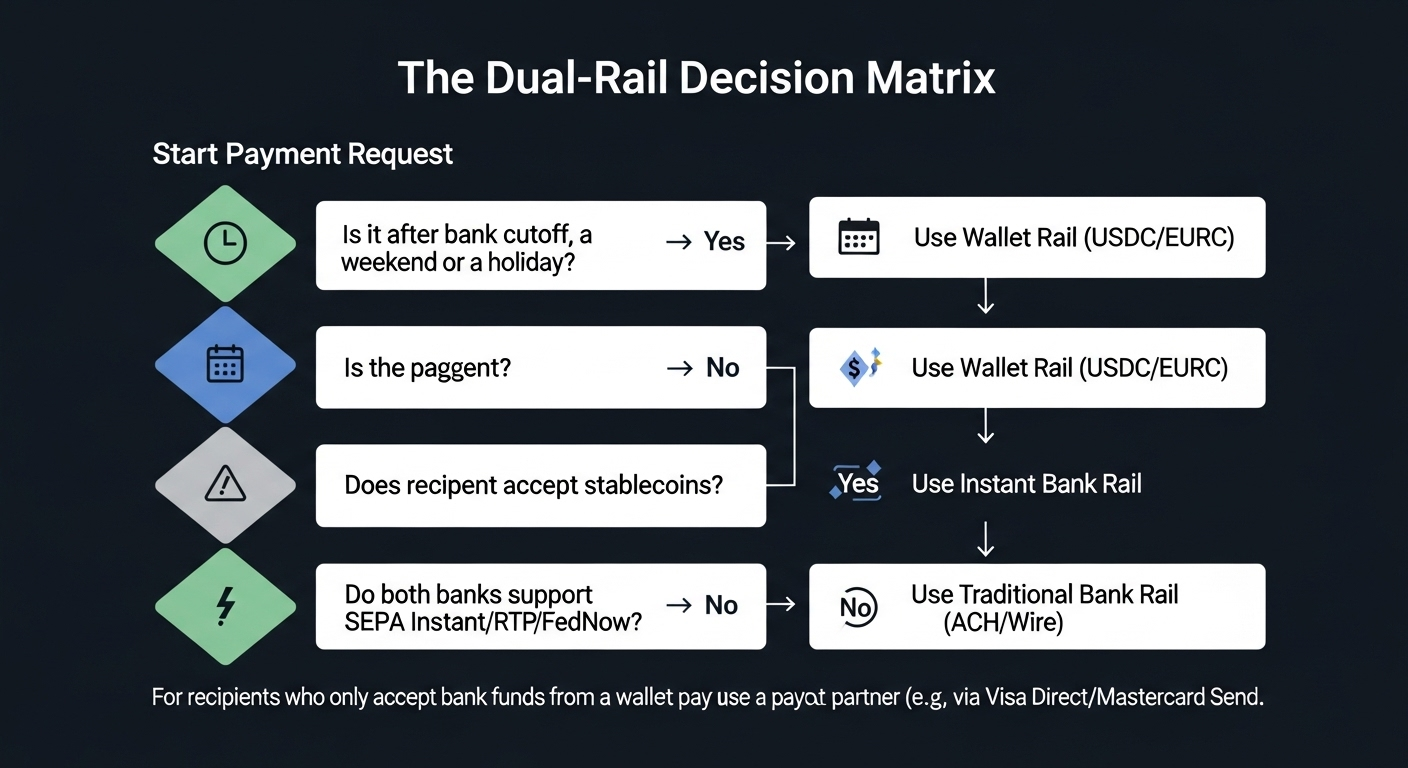

The solution is a simple dual-rail payment system. This approach combines the reliability of traditional bank rails for standard business hours with the continuous availability of 24/7 instant rails, powered by stablecoins and new real-time bank networks. By integrating both, businesses can ensure payments are always possible, eliminating costly delays and maintaining financial agility around the clock.

Anatomy of a Dual-Rail System

A dual-rail system provides two payment lanes. The Bank Rail uses traditional, time-bound methods like ACH, SEPA, and wire transfers. The Wallet Rail enables 24/7 payments through new real-time bank networks and stablecoins like USDC (a digital dollar) and EURC (a digital euro) from Circle. These are redeemable 1:1 for bank-held currency; the EU’s MiCA regulation grants formal redemption rights to EURC holders. While bank rails are slow, on-chain stablecoin transfers process in minutes for tiny fees, such as Solana’s sub-cent base fees.

The Modern Instant Rail Landscape

The Wallet Rail is supported by three major 24/7 bank networks. In the US, The Clearing House’s RTP network operates 24/7, processed 343M payments in 2024, and will raise its per-payment limit to $10M in February 2025. The Fed’s FedNow service is projected to reach over 1,400 participants by July 2025, with its limit increasing to $10M in September 2025. In the EU, the Instant Payments Regulation mandates 24/7 crediting in under 10 seconds for SEPA Instant transfers. As a near real-time fallback, push-to-card networks like Visa Direct and Mastercard Send make funds available in ~30 seconds to under 30 minutes.

Practical Setup: Architecture and Operational Workflow

Setup is a one-time configuration. First, pre-fund a business wallet with a small float equal to 2-5 days of expected after-hours payouts. Then, select a payment architecture.

For crypto-native recipients (Pattern A), move funds from your bank to Circle Mint, then to your wallet for direct payment to a supplier’s wallet. For fiat-only recipients (Pattern B), send stablecoins from your wallet to a payout partner for conversion and deposit into the recipient's bank. For EU merchants (Pattern C), prioritize SEPA Instant and use the wallet rail as a fallback.

Finalize by opening a business-grade wallet, enabling 2FA/multi-sig, whitelisting recipient addresses, and defining a strict float cap.

Managing Risk and Maintaining Compliance

Limit wallet floats to 2-5 days of expected payouts to minimize exposure, a lesson from the temporary USDC de-peg in March 2023. Mandate two-person approval for large sends and strictly whitelist all recipient addresses. Maintain a clear de-peg plan: redeem the stablecoin or switch back to the bank rail (Investopedia). For compliance, label each payment by its rail and reconcile weekly using bank statements, wallet explorers, and payout reports. In the EU, MiCA’s formal redemption framework for EU-issued stablecoins increases merchant confidence (goodwinlaw.com).