Introduction: Beyond Trading Fees

In the volatile crypto market, stablecoins like USDC provide a crucial anchor of stability. For users holding these assets, maximizing returns without taking on excessive risk is paramount. While many view the Coinbase One subscription primarily as a way to save on trading fees, its greater value lies in yield generation and account protection. The service boosts the rewards on USDC holdings, offering a 5.1% APY as of late 2023 (Source_1).

Beyond stablecoins, members receive higher staking rewards on assets like ETH, ADA, and SOL, all backed by a $1 million account protection guarantee (Source_2). This article provides a clear, no-nonsense analysis of how to use Coinbase One to maximize your USDC and staking yields. We will cut through the marketing to examine the real numbers, showing you how to navigate potential surprises like balance caps and blended rates to ensure you are earning the returns you expect.

The Core Math: USDC Yield vs. Staking Discounts

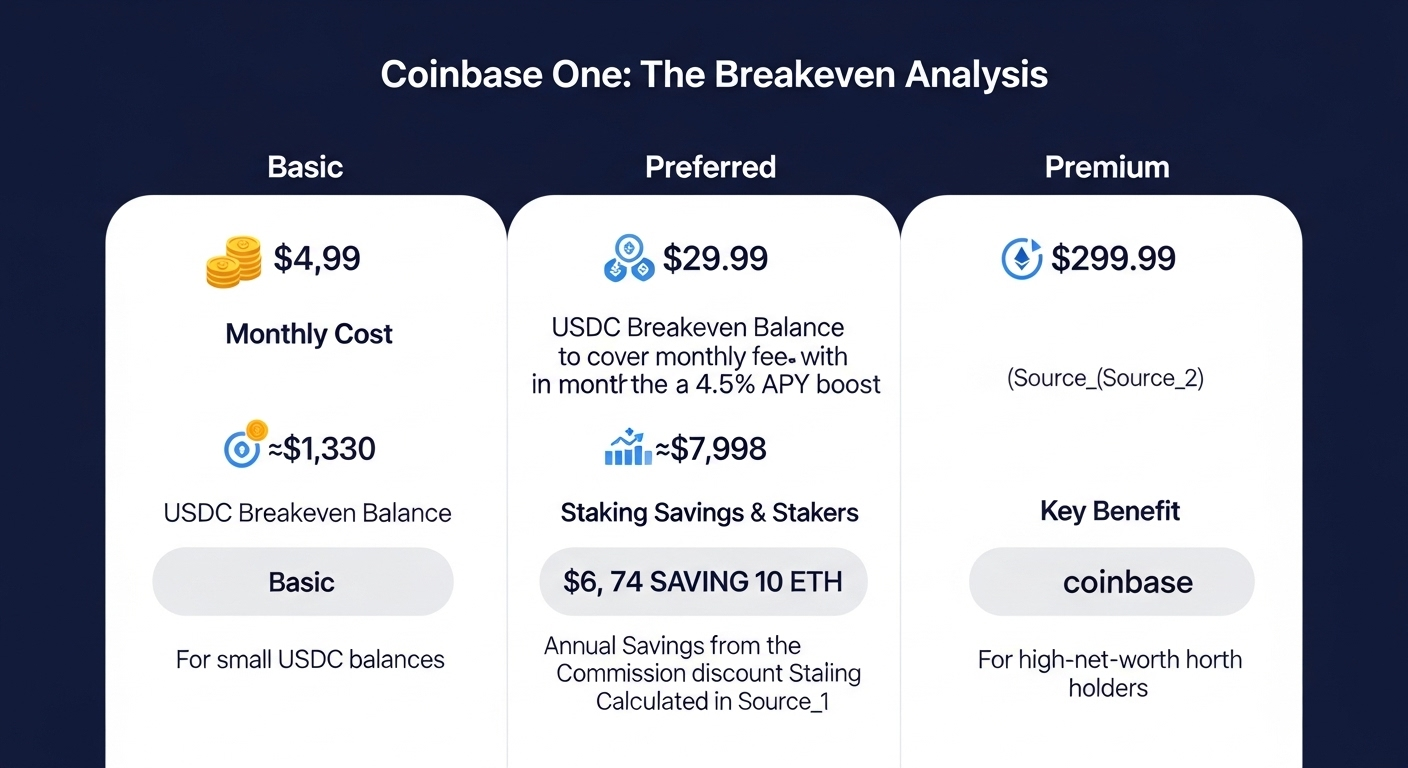

Members earn a boosted 4.5% APY on USDC holdings, subject to tier-based balance caps. The Basic tier applies this rate up to $10,000, the Preferred tier up to $30,000, and the Premium tier has no balance cap (Source_1, Source_2).

For staking, Coinbase’s standard 35% commission on rewards is reduced, directly increasing net yield. The commission drops to 31.75% for the Basic plan, 28.5% for Preferred, and 25.25% for Premium. As a concrete example, a user staking 10 ETH (~$30,000) on the Preferred plan sees their commission fall from 35% to 28.5%. The calculation in Source_1 shows this generates approximately $78 in additional annual earnings, assuming a 4% base reward rate.

Reading the Fine Print: Caps, Rebates, and Protection

The boosted USDC APY applies only up to your tier’s balance cap. Any funds held above this limit earn the standard, lower rate, creating a blended APY. For example, a Preferred member with a $30,000 cap holding $40,000 in USDC earns the boosted rate on the first $30,000 and the standard rate on the remaining $10,000. This results in a blended APY of 3.75% on the total balance, not the full boosted rate on the entire amount (Source_1).

The "zero trading fees" benefit is also nuanced. It applies only to "simple" trades and is subject to a monthly volume limit. Coinbase Advanced trades are not free; instead, members receive a 25% rebate on their trading fees, paid in USDC. This rebate is capped monthly, with the Preferred plan limited to $100 in rebates per month (Source_2).

Finally, the account protection is a specific account takeover warranty, not all-encompassing insurance. It covers losses from unauthorized activity if your account credentials are compromised. Reimbursement is tiered: up to $1,000 for Basic, $10,000 for Preferred, and $250,000 for Premium members (Source_2). This warranty is separate from Coinbase’s general crime insurance and only covers losses from unauthorized access to your Coinbase account under specific terms.

Actionable Strategy: Which Tier is Right for You?

For users holding $5,000 to $30,000 in USDC, the Preferred plan offers the best return on yield alone. Its $30,000 balance cap ensures your entire balance earns the boosted APY, making the gains justify the subscription cost. Do: Select the Preferred tier to maximize yield on up to $30,000. Don't: Avoid holding balances above the $30,000 cap, as this creates a lower blended APY and diminishes returns.

The Preferred plan is also ideal for active traders and stakers. The value comes from combining benefits: a 25% fee rebate on Coinbase Advanced trades (up to $100/month), a reduced staking commission (down to 28.5%), and boosted USDC yield. For a frequent trader staking assets like ETH or SOL, these combined savings and earnings can significantly exceed the plan's cost. Do: Execute all trades on Coinbase Advanced to ensure you receive the 25% fee rebate. Don't: Rely on "simple" trades, which are volume-capped and do not provide rebates.

For those with six-figure balances, the Premium tier is essential. Its primary value is the unlimited balance cap for the boosted USDC APY, preventing rate dilution and ensuring your entire stablecoin portfolio earns maximum yield. The second key benefit is the increased account takeover warranty, offering up to $250,000 in protection against unauthorized access. Do: Consolidate significant USDC holdings to leverage the uncapped boosted APY. Don't: Mistake the account protection for all-purpose insurance; it only covers specific unauthorized access events.

Conclusion: Yield with Guardrails

Coinbase One can effectively turn idle USDC into a productive, protected asset, but its value is not automatic. Profitability is entirely dependent on your specific activity—your USDC balance, staking habits, and trading volume. The service only pays off when your holdings and actions align with a tier's benefits, like the Preferred plan's $30,000 USDC cap or the Premium tier's uncapped yield. For others, the subscription may not justify its cost.

Before committing, you must do the math for your own situation. Calculate your potential earnings from boosted yields, staking discounts, and trading rebates against the membership fee. This crucial step is the only way to ensure Coinbase One becomes a tool for real savings, not just another monthly expense.