The Strategic Pivot: From DDR4 Dominance to a DDR5 Offensive

ChangXin Memory Technologies (CXMT) has emerged as a pivotal force in China's national strategy for technological independence. The company rapidly carved out a significant share of the DDR4 market, directly challenging the long-held oligopoly of Samsung, SK Hynix, and Micron. As its manufacturing matured, CXMT’s DDR4 output was reportedly approaching a formidable 300,000 wafers per month, signaling its arrival as a globally competitive memory producer.

However, in a sudden, government-backed strategic shift, CXMT is now prioritizing DDR5 production. According to reports from Tom's Hardware and DigiTimes, this pivot was executed just as its DDR4 operations reached peak efficiency. This move is far more than a standard product evolution; it represents a calculated geopolitical and economic maneuver. By forgoing immediate DDR4 profits, Beijing and CXMT are making a high-stakes bet on future self-sufficiency. The decision to leapfrog directly into the next-generation memory space is a pre-emptive strike designed to insulate China's high-tech industries from foreign supply chain vulnerabilities and secure a critical advantage in the ongoing global technology race. This underscores a clear state-driven ambition to lead, not just compete, in foundational semiconductor technologies.

The Production Paradox: Aggressive Scale vs. a Persistent Technology Gap

CXMT’s production capabilities highlight a strategy of brute-force scaling. The company demonstrated impressive wafer output growth, surging from approximately 70,000 wafers per month in 2022 to over 200,000 in early 2024. This rapid expansion, however, masks a significant technological gap.

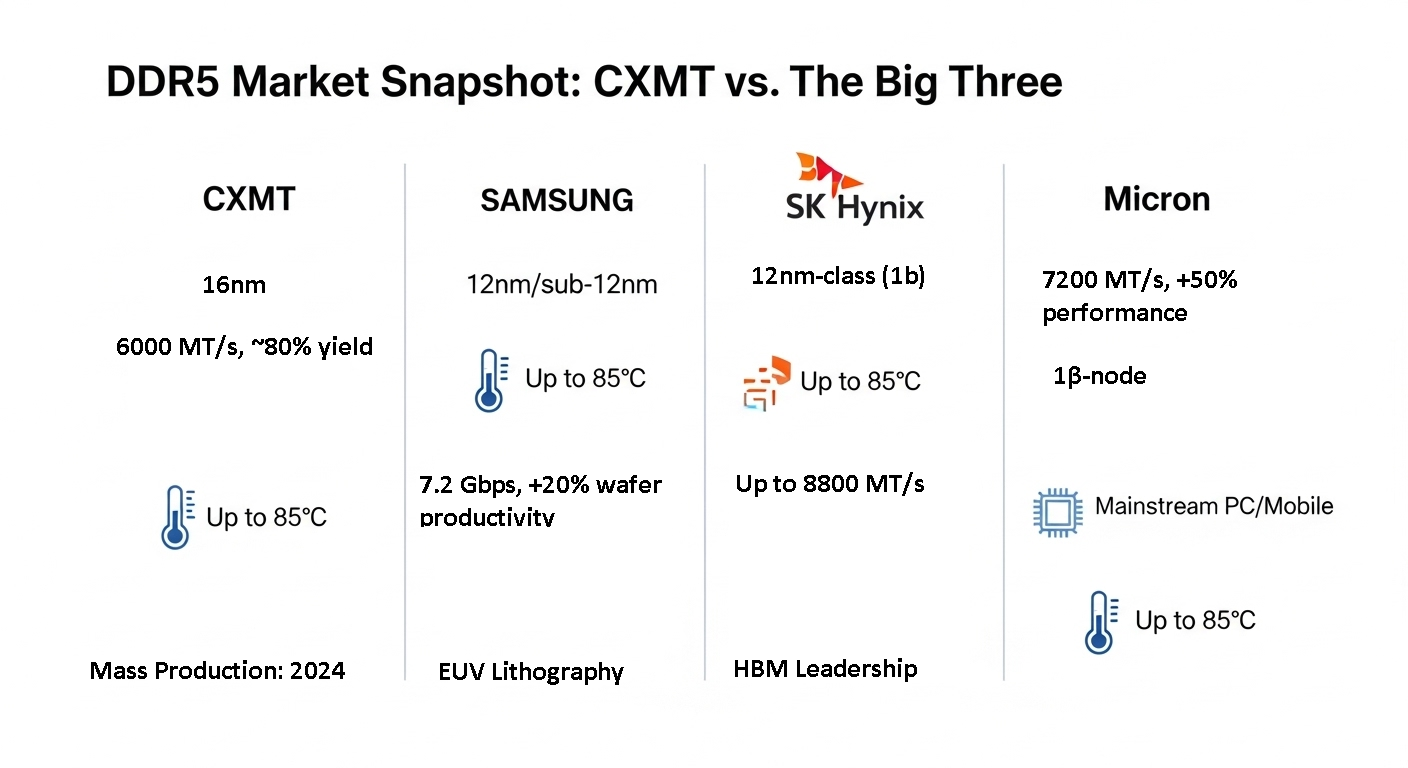

CXMT’s new DDR5 memory is produced on a 17nm process node. This technology lags considerably behind the cutting-edge 12nm processes already employed by its Korean and American rivals, Samsung and SK Hynix. To initiate its DDR5 offensive, the company’s new Fab 2 facility in Hefei is reportedly targeting an initial production capacity of 50,000 wafers per month.

This approach reveals the core paradox of China's memory strategy: attempting to compensate for a technological deficit with sheer manufacturing scale. By flooding the market with massive volumes of slightly older technology, CXMT aims to secure market share and build industrial capacity, even while playing catch-up on the underlying process innovation. The success of this high-volume, lower-tech gamble will be a critical test of its state-backed push for semiconductor self-reliance.

Repeating the Playbook: The Anticipated DDR5 Price War

CXMT's market strategy for DDR5 mirrors its successful DDR4 playbook: leveraging aggressive pricing to seize market share. Previously, the company used significant discounts to undercut rivals, forcing them to scale back production. This same tactic is now being deployed for its next-generation memory, with projections indicating a substantial impact. Taiwanese firm Silicon Motion estimates that this DDR5 launch could propel CXMT's global DRAM market share from under 2% in 2021 to a formidable 15% by the end of 2025.

Underpinning this offensive is surprisingly rapid manufacturing maturity. Reports indicate that initial DDR5 production yields started at an impressive 50% and quickly climbed to 80%. This high efficiency, combined with massive planned capacity, positions CXMT to inundate the mainstream market. The initial focus will be on satisfying China's domestic demand as part of its self-sufficiency mandate. However, the sheer volume of this new supply is expected to exert significant downward pressure on global DDR5 prices, potentially triggering a price war and reshaping the memory market landscape.

A Critical Weakness: The 60-Degree Celsius Problem

However, a critical technical limitation threatens to undermine CXMT’s market offensive. Reports from DigiTimes indicate that the company’s current DDR5 chips struggle with stability at temperatures exceeding 60°C. This performance ceiling is a significant disadvantage compared to memory from competitors like Samsung, which is reliably rated for operation up to 85°C.

The implications of this thermal deficit are profound. While the chips may be suitable for some consumer PCs and smartphones where thermal loads are less extreme, they are effectively disqualified from the high-margin enterprise server and high-performance computing (HPC) markets. These sectors demand unwavering reliability under sustained, high-temperature conditions, a standard CXMT’s current offerings cannot meet. This single technical flaw serves as a crucial counterpoint to their aggressive production scale, confining their immediate threat to the consumer segment and underscoring the persistent technology gap they must close to compete across the entire memory landscape.

Market Impact and the Next Frontier: HBM

CXMT's strategic pivot carries immediate and far-reaching consequences. The most direct impact is a sharp disruption in the legacy market; as the company reallocates its vast capacity, prices for 8GB DDR4 chips have reportedly surged by an astonishing 150%. This illustrates the market power CXMT has already achieved and the collateral effects of its state-directed mission.

Simultaneously, the company is preparing to repeat its playbook in the next-generation arena. The massive influx of its 17nm DDR5 chips is poised to trigger a significant price war. While this will benefit consumers with more affordable memory, it will inevitably squeeze the profit margins of established leaders like Samsung and SK Hynix, forcing a market-wide recalibration.

Beyond this DDR5 offensive, CXMT's ultimate ambitions are becoming clear. The company has begun sampling HBM2 memory, targeting domestic partners like Huawei for high-performance computing. Although this technology is generations behind the HBM3E and HBM4 offerings from its rivals, the move is a powerful signal. It underscores a methodical, state-backed strategy to achieve self-sufficiency across all tiers of the memory market. By tackling high-bandwidth memory, CXMT demonstrates it is willing to accept initial technological deficits in its relentless pursuit of comprehensive semiconductor independence, from consumer DRAM to the most advanced enterprise solutions.