The Strategic Uncoupling: Darden Signals an End for Bahama Breeze

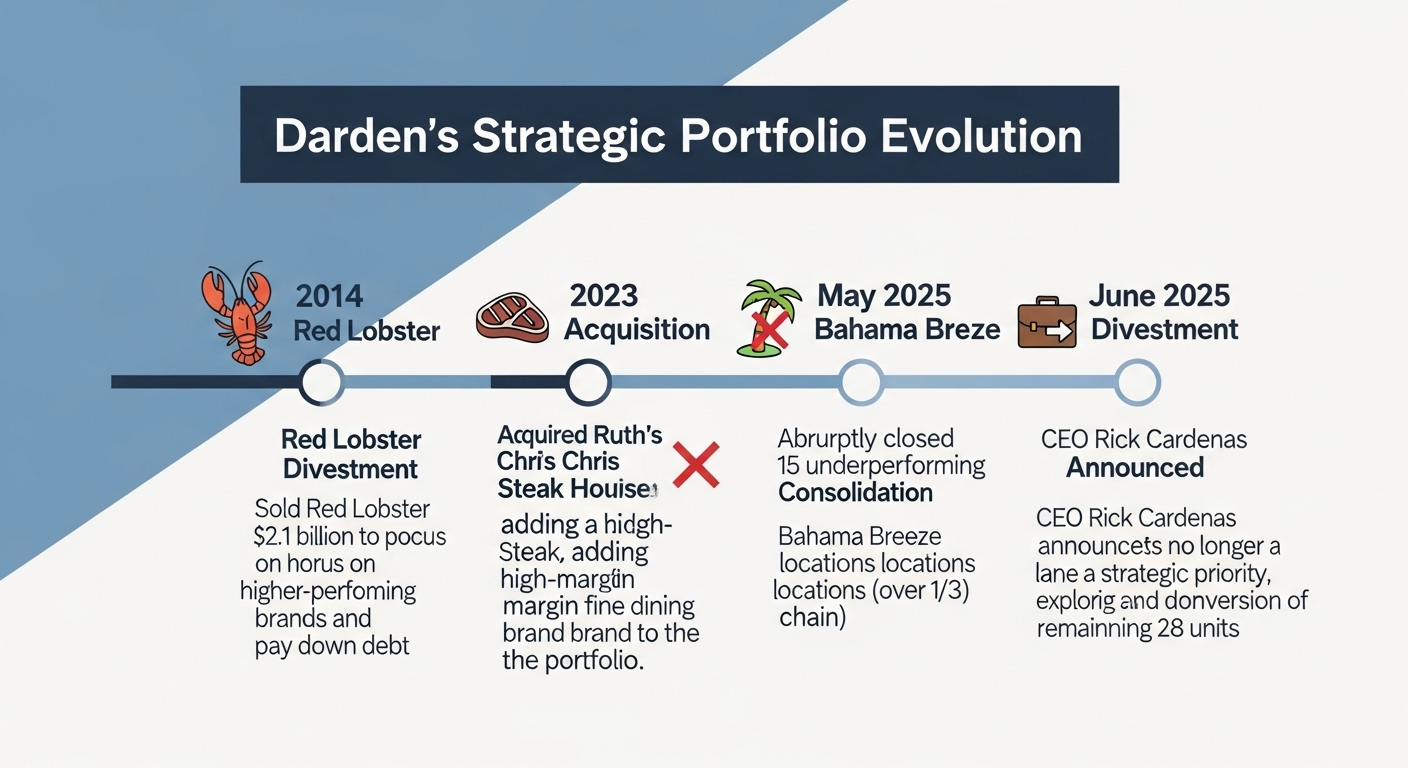

During its June 20, 2025 earnings call, Darden Restaurants announced a significant shift in its portfolio strategy, with CEO Rick Cardenas declaring that the Bahama Breeze brand is no longer a strategic priority. This move follows the abrupt closure of 15 underperforming Bahama Breeze locations in May 2025, a decision that reduced the chain’s footprint to just 28 units.

Cardenas outlined two potential outcomes for the Caribbean-themed chain. Darden is now exploring a full sale of the brand to another operator. The alternative path involves converting the remaining restaurant locations into other, more successful concepts from Darden’s portfolio.

Rather than a sign of weakness, the decision is framed as a calculated portfolio management maneuver. This strategic pivot is contextualized by Darden's exceptional overall financial health. The company reported strong Q4 2025 results, including total sales of $3.27 billion, representing a 10.6% year-over-year growth. This robust performance enables Darden to divest from a non-core asset and reallocate resources toward its primary growth engines.

Deconstructing the Rationale: Performance, Priority, and Portfolio Fit

Darden's decision to divest from Bahama Breeze is a clear-cut case of strategic pruning. The Caribbean-themed chain no longer aligns with the company's high-growth portfolio standards. CEO Rick Cardenas confirmed the brand fails to meet Darden's "criteria" for long-term investment, stating the company is unwilling to "put a lot of investment into Bahama Breeze" to engineer a turnaround.

This stance is rooted in performance data. Bahama Breeze's sales declined by nearly 8% last year, a stark contrast to the sustained growth at flagship brands like Olive Garden and LongHorn Steakhouse. Darden's focus is clearly on these powerhouses and integrating its successful acquisition of Ruth's Chris Steak House, not on rehabilitating a lagging concept.

The May closure of 15 locations was a deliberate preparatory move. By shedding the weakest restaurants, Darden intentionally isolated the "highest performing" units. This action streamlines the portfolio, making the remaining 28 locations a more attractive asset for a potential sale or a more manageable candidate for conversion into other Darden concepts. Ultimately, Darden is shedding a low-growth, non-core asset to reallocate capital and management attention toward its proven growth engines, ensuring resources are focused where they can generate the highest returns.

The Two Paths Forward: Analyzing the Sale vs. Conversion Scenarios

Darden has outlined two strategic alternatives for the 28 remaining Bahama Breeze locations: a complete sale or internal conversion. A sale offers the brand a chance for revival under new leadership. CEO Rick Cardenas noted the chain could "benefit from a new owner," suggesting a buyer willing to invest the focused capital Darden will not. The most likely suitors are smaller restaurant groups seeking to acquire a proven concept or private equity firms specializing in brand turnarounds. For such a buyer, the package is attractive: 28 of the highest-performing units and an established, distinct Caribbean theme, offering a turnkey operation with a loyal customer base.

The second alternative involves converting the prime real estate into other, more successful Darden brands. This strategy leverages existing assets to accelerate growth where it matters most. The top candidates for conversion are Yard House and Cheddar’s Scratch Kitchen. Both brands are on a strong growth trajectory and often require a similar large-format footprint to Bahama Breeze locations. Converting these sites is significantly more cost-effective and faster than sourcing and building new restaurants from the ground up, allowing Darden to quickly expand its high-performing concepts in proven markets.

Regardless of the path chosen, Darden has signaled the financial implications will be minimal. The company does not expect the divestiture to have a "material impact" on its overall financial results. This statement underscores the relatively small scale of Bahama Breeze within the Darden empire and frames the decision not as a loss, but as a calculated, low-risk maneuver to reallocate resources toward its primary growth engines.

The Darden Playbook: A Pattern of Disciplined Capital Allocation

The decision to divest from Bahama Breeze is not an isolated event but a consistent application of Darden's long-term portfolio management philosophy. This strategy is rooted in a disciplined, unsentimental evaluation of each brand's performance and strategic fit. The most significant historical precedent is the 2014 sale of Red Lobster. In a much larger-scale move, Darden shed its founding brand when it no longer met growth expectations, freeing up capital and management focus for higher-performing concepts. The Bahama Breeze situation is a direct echo of that playbook: prune underperforming assets to strengthen the core.

This divestment strategy is the corollary to Darden’s highly selective acquisition approach. While it sheds low-growth brands, it actively invests in high-value segments that align with its portfolio. The 2023 acquisition of Ruth's Chris Steak House for $715 million is the prime example. Darden bought into the fine-dining segment, adding a high-margin, high-growth brand that complements its existing steakhouse powerhouse, LongHorn. This dual strategy of calculated pruning and strategic acquisition is what CEO Rick Cardenas calls an "adherence to our winning strategy, anchored in our four competitive advantages and being brilliant with the basics."

Ultimately, Darden operates as a portfolio manager, not a brand sentimentalist. Each concept, from Olive Garden to Bahama Breeze, is constantly measured against strict internal benchmarks for sales growth, profitability, and overall strategic alignment. The fate of Bahama Breeze demonstrates that any brand failing to meet these criteria will be either sold or repurposed, ensuring resources are perpetually channeled toward the assets with the highest potential for return.

Market Impact and Key Takeaways for Industry Leaders

Darden's divestment from Bahama Breeze provides a masterclass in disciplined portfolio management for the restaurant industry. The primary takeaway is the critical importance of "portfolio hygiene." Darden demonstrates that even a financially healthy parent company must make unsentimental decisions about non-strategic assets. Proactively pruning a brand that no longer meets growth criteria prevents it from becoming a long-term drain on capital and management attention, ensuring resources are concentrated where they can generate maximum returns.

Secondly, the fate of Bahama Breeze highlights the inherent vulnerability of highly-themed, niche casual dining concepts. In a competitive landscape, such brands can struggle to achieve the scale and maintain the broad consumer relevance necessary for sustained growth, especially when compared to portfolio powerhouses like Olive Garden or LongHorn Steakhouse. Their limited appeal makes them prime candidates for divestment when they fail to perform.

Ultimately, Darden's strategy validates the principle that focus drives value. By shedding a marginal asset, the company is doubling down on its core growth engines and high-potential acquisitions like Ruth’s Chris. This disciplined reallocation of resources is a clear path to creating long-term shareholder value. The move sets a powerful precedent, prompting a forward-looking question for the sector: which other multi-brand operators, facing their own portfolio challenges in the current economic climate, will be next to adopt Darden’s playbook?