The Pain of Waiting: Why Settlement Delays Hurt Your Business

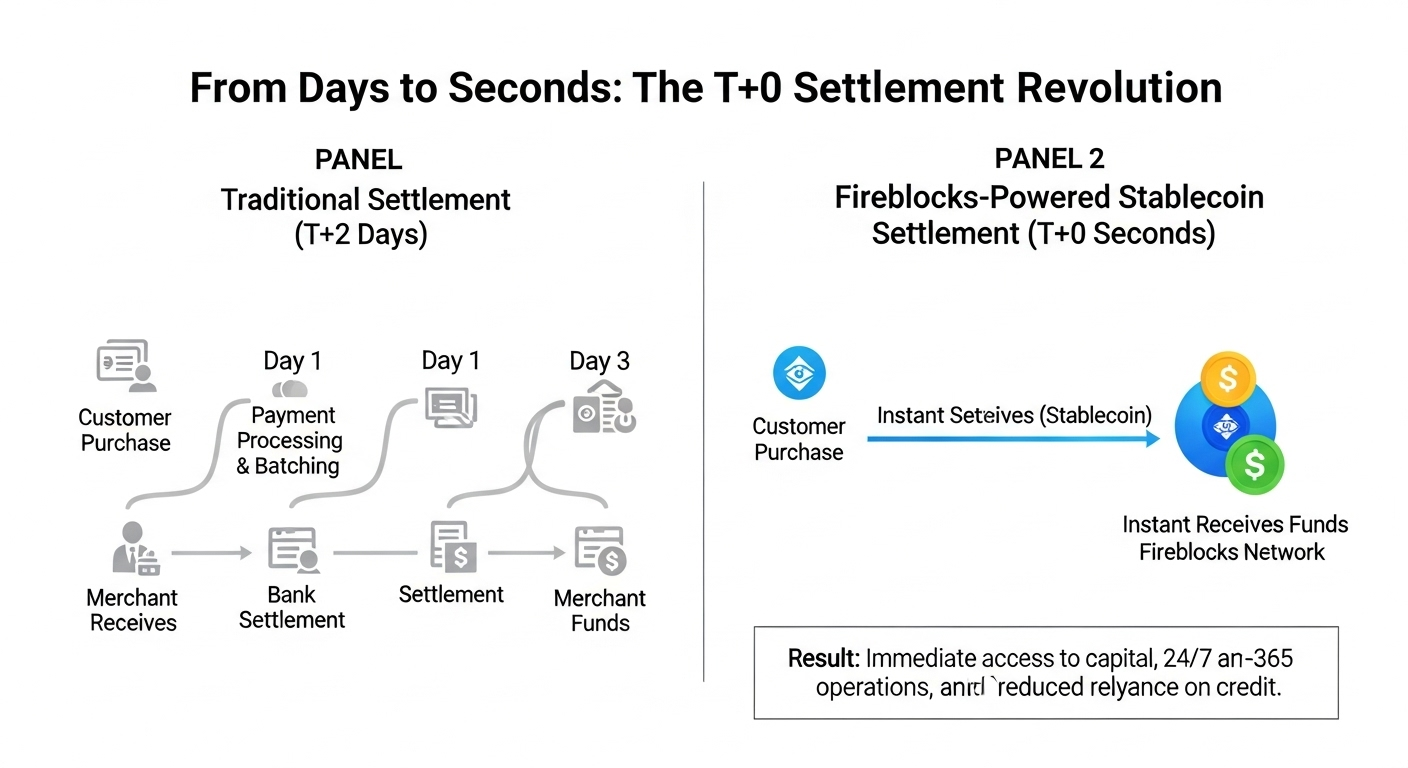

Traditional payment settlement is a fundamental drag on business growth. For most card and ACH transactions, merchants are subject to a T+1, T+2, or even T+3 settlement cycle, meaning they wait one to three business days after a sale to receive their funds. This inherent delay creates significant operational friction. Businesses are forced to rely on expensive credit lines to cover daily expenses like payroll and rent, waiting for their own earned revenue to arrive.

This lag directly stalls progress. Opportunities to reinvest in high-demand inventory or launch timely marketing campaigns are missed. The problem is magnified for cross-border sales, where settlement delays and currency conversions introduce severe cash flow uncertainty. In this competitive landscape, waiting for your money is a liability. Real-time, T+0 settlement is not a mere convenience—it is a critical strategic advantage, enabling immediate reinvestment, optimized cash flow, and accelerated growth. Access to capital the moment it is earned separates market leaders from the competition.

The New Rails: How Stablecoins and Fireblocks Deliver T+0

Stablecoins provide the solution, acting as new, instant payment rails that operate 24/7/365 to eliminate settlement delays. Fireblocks delivers the secure infrastructure for Payment Service Providers (PSPs) to build T+0 offerings on these rails.

The Fireblocks Payments Engine orchestrates these flows, while the Network for Payments provides blockchain-agnostic connectivity. The platform embeds critical compliance, including AML/KYT screening and Travel Rule adherence, directly into the transaction process. All funds are secured within enterprise-grade MPC wallets.

This technology is mature and operating at scale. In 2024, nearly half of all transactions on the Fireblocks platform were stablecoins, representing approximately 15% of the total global volume. Instant, secure, and compliant settlement is a present-day reality, enabling businesses to access capital the moment it is earned.

Proof in Practice: Worldpay's Global T+0 Settlement

This technology is proven at scale by Worldpay, a leading global payment processor. To eliminate settlement delays for its merchants, Worldpay integrated Fireblocks to deliver 24/7/365, T+0 stablecoin settlement. The entire solution was built and launched in just weeks.

The impact was immediate and substantial. This single platform replaced dozens of fragmented local settlement systems, unifying global treasury operations and creating significant efficiency gains. The result was a fundamental shift in settlement speed. As Worldpay stated, "Settlements moved from days to seconds." This is not a pilot program; it is a live, large-scale deployment by an industry giant, demonstrating that instant, secure, and compliant settlement is a present-day reality for businesses worldwide.

The Bottom-Line Impact: Key Benefits for Merchants

For merchants, T+0 settlement delivers transformative advantages for growth and operational control.

- Immediate Access to Funds: Receive revenue the moment a sale is made. This eliminates waiting and frees working capital for immediate reinvestment in inventory or marketing.

- Predictable Cash Flow: With instant, 24/7 settlement, revenue is available on demand. This removes the uncertainty of traditional delays, enabling precise budgeting and financial planning.

- Lower Operating Costs: Reduce expenses with processing fees potentially over 50% lower than card payments. Immediate fund availability also minimizes the need for expensive credit lines.

- Finality & Security: Blockchain transactions are final, eliminating the cost and risk of chargebacks. Funds settle securely without the possibility of payment reversals.

- Global Agility: A single stablecoin rail simplifies cross-border expansion by removing local banking complexities and currency conversion delays, enabling faster entry into new markets.

Under the Hood: The Technology That Builds Trust

Trust in this new payment infrastructure is built on a foundation of institutional-grade security and proven performance. Fireblocks employs advanced cryptographic protocols, including MPC-CMP and MPC-BAM, to secure the entire transaction lifecycle. These protocols deliver a dual advantage: they fortify security while accelerating wallet creation and transaction signing by up to 8x-100x compared to older standards. This breakthrough performance is essential for processing payments at enterprise scale without compromising on safety.

The platform’s architecture reinforces this security-first approach. Payment providers can leverage Embedded Wallets, a non-custodial model that eliminates the provider's need to manage private keys, drastically reducing operational risk and the potential for a single point of failure. Beyond cryptographic security, the system is designed for regulatory reality. Critical compliance tools, including AML/KYT screening and Travel Rule adherence, are embedded directly into the payment flow. This built-in compliance makes the solution immediately usable and audit-ready for regulated financial institutions like Worldpay, ensuring that speed and security are matched by unwavering regulatory integrity.

A Balanced View: Risks and Considerations

While T+0 settlement offers clear advantages, merchants must also evaluate the associated risks. The primary concern is stablecoin issuer risk; the asset's stability is directly dependent on the credibility and transparency of the issuer’s reserves. Technical challenges also exist. Blockchain network congestion can lead to unpredictable fees and settlement delays, while vulnerabilities in smart contract code could disrupt payment flows.

Furthermore, practical friction remains in converting stablecoins back to fiat currency. Reliable and cost-effective “off-ramps” are essential for realizing cash flow benefits, but liquidity can vary. Finally, the regulatory landscape for digital assets is still evolving. New frameworks, such as Europe’s Markets in Crypto-Assets (MiCA) regulation, are establishing rules that will shape stablecoin usage and introduce new compliance obligations. A thorough assessment of these factors is critical for any business adopting this new payment infrastructure.

The Future of Merchant Payments is Instant

The era of waiting for earned revenue is ending. Settlement delays, a long-standing drag on business growth, are now being solved at scale by industry leaders using stablecoin payment rails. This shift is supported by a mature and liquid market. A recent BCG report projects the stablecoin market will exceed a $210 billion market cap with approximately $26.1 trillion in annual on-chain volume, providing the depth required for global enterprise settlement.

As this technology moves from a niche concept to a mainstream financial tool, the competitive landscape is being redrawn. T+0 settlement is no longer a future possibility but a present-day reality that unlocks immediate working capital and accelerates growth. The time is now for merchants to ask their payment providers a critical question: What is your roadmap for delivering instant, stablecoin-based T+0 settlement?