Your Business Doesn't Stop at 5 PM. Your Payments Shouldn't Either.

It's Friday afternoon, and you need to send money. Your bank won't process it until Monday. For decades, we've accepted that money simply stops on weekends and holidays. This banking cutoff creates frustrating delays for everything from paying a contractor to helping a family member in a pinch. The 9-to-5 financial system hasn't kept up with our 24/7 world.

There’s a simple, practical solution: a 'dual-rail' approach. You continue using your trusted bank for normal business hours. Alongside it, you operate a small, secure digital currency wallet that's always on. This second rail uses digital dollars (USDC) or euros (EURC) that move instantly, any time, day or night. Think of it as a financial 'after-hours' lane, giving you the freedom to transact when traditional systems are closed.

This article is a plain English, practical guide. We're not diving into complex technology. Instead, in the next 15 minutes, we'll show you how to set up a wallet, run a tiny €/$25 test to see it work for yourself, and establish simple safety rules for peace of mind. By the end, you'll have a reliable 24/7 payment option ready when you need it most.

What Are USDC & EURC? (The 30-Second Explanation)

USDC and EURC are digital dollars and digital euros issued by the regulated financial company Circle. Think of them as email for money: they move instantly across the internet, 24/7, just like sending an email.

Unlike volatile cryptocurrencies, they are designed for stability. Each USDC is fully backed 1:1 by a U.S. dollar held in cash and short-term U.S. government bonds. This means you can always redeem your digital currency for traditional dollars sent to your bank account. The same principle applies to EURC and euros.

For businesses in the European Union, the Markets in Crypto-Assets (MiCA) regulation provides a formal legal framework for these digital euros, guaranteeing your redemption rights and adding a powerful layer of security and trust.

The 'Dual-Rail' Strategy: Bank Lane vs. Wallet Lane

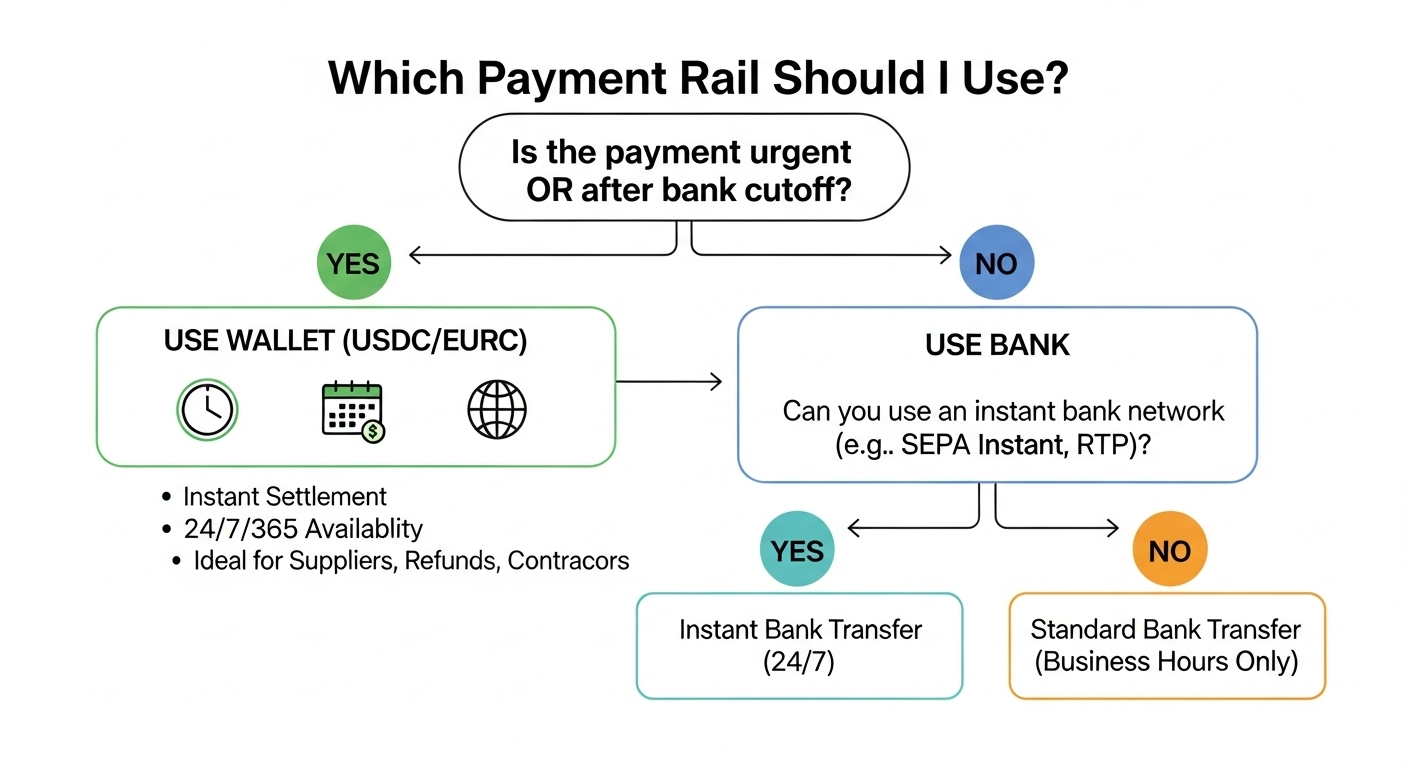

The dual-rail model provides financial flexibility by complementing your bank, not replacing it. It establishes two distinct channels for payments based on urgency.

Rail A is your bank. Use this primary rail for standard, non-urgent transactions like traditional wires and SEPA transfers during business hours. It’s your trusted system for core financial operations.

Rail B is your digital wallet. This is your express lane for urgent, after-hours, and weekend payments. By holding a balance of USDC or EURC, you can send and receive money instantly, 24/7. This rail is for when waiting until Monday isn't an option.

This shift to always-on finance is a global trend. Banks are upgrading with real-time networks like SEPA Instant in Europe and RTP/FedNow in the U.S., with some networks now supporting single transactions into the millions. A USDC/EURC wallet is another powerful, globally accessible tool in this modern payment toolkit, ensuring you always have a way to move money when you need to.

Your 15-Minute First Transaction Guide

-

Open Your Business Wallet (5 min): Choose a regulated provider and complete the Know Your Business (KYB) verification. Secure your account by enabling two-factor authentication (2FA).

-

Secure Your Access (2 min): Store your login credentials in a secure password manager. For business accounts, establish a two-person approval policy for all outgoing payments.

-

Add a Tiny Float (3 min): Initiate a small bank transfer (e.g., €/$25) to your wallet's account details. This will automatically convert, or 'mint', your funds into an equivalent balance of USDC or EURC.

-

Send a Test Payment (3 min): Add a trusted colleague’s wallet address to your 'whitelist' or address book. Send a €/$10 test payment to this address to confirm the funds arrive instantly.

-

Cash Back Out (2 min): Use the wallet's 'redeem' or 'withdraw' function to convert your remaining digital currency back into traditional dollars or euros, sending them directly to your linked bank account.

When to Use It: Three Real-World Merchant Scenarios

Real-World Scenarios: Your 24/7 Wallet in Action

Here are three common business situations where a dual-rail strategy provides an immediate solution when traditional banking can't.

1. Paying a Supplier After 5 PM on a Friday You need to pay an invoice to release a shipment, but it's Friday evening and banks are closed. Instead of waiting until Monday, send the required USDC or EURC directly from your wallet to your supplier’s. They receive the funds instantly, confirming payment and allowing your business to proceed without costly delays.

2. Issuing an Urgent Weekend Refund A customer requires an immediate refund on a Saturday to resolve a service issue, but traditional refunds won't process until the next business day. Use a payout service connected to your wallet to send USDC, which instantly converts and lands in the customer's bank account or on their card. The issue is resolved immediately, protecting your reputation.

3. Paying International Contractors Paying a freelancer overseas often involves high wire fees, poor exchange rates, and multi-day delays. If your contractor accepts digital currency, you can bypass this system entirely. Send USDC or EURC from your wallet directly to theirs. The payment arrives in minutes with minimal fees, settling the invoice efficiently.

Simple Guardrails for Safe, Boring Operations

To use your wallet safely, treat it like a digital cash register, not a bank vault. Implement these three essential rules for peace of mind:

-

Keep a Small Float: This is your most important safety rule. Only hold enough funds for 2-5 days of expected payments. While stablecoins like USDC are highly reliable, they are not risk-free. During the 2023 Silicon Valley Bank crisis, USDC briefly lost its 1:1 peg with the U.S. dollar before recovering. Limiting your float minimizes exposure to rare but possible market or operational risks.

-

Require Two-Person Approvals: For payments over a set threshold, such as €/$1,000, mandate approval from a second team member. This policy prevents unauthorized or mistaken large transactions.

-

Use an Address Whitelist: Only enable payments to pre-approved, verified wallet addresses. This acts as a powerful safeguard, ensuring funds are only sent to trusted recipients and preventing costly mistakes.

FAQ: Your Questions, Answered Directly

Is this just another volatile cryptocurrency? No. USDC and EURC are regulated digital dollars and euros, not speculative assets. Each is backed 1:1 by real currency. We treat them like digital cash for payments, not investments, and use strict controls like small floats and address whitelists for safe, boring operations.

Do I have to switch from my current bank? Absolutely not. This 'dual-rail' approach complements your bank; it doesn’t replace it. Continue using your bank for standard operations. The digital wallet is simply an additional payment lane for urgent, after-hours, or weekend transactions when traditional systems are closed.

Is accounting for this complicated? No, it’s straightforward. Treat it like a digital petty cash ledger. For each transaction, log the amount, date, and purpose. The public transaction link serves as a verifiable digital receipt. Reconcile this simple log with your wallet balance weekly, just as you would any other account.

What if my supplier only accepts bank transfers? You can still pay them instantly, 24/7. Use a regulated payout service connected to your wallet. You send USDC or EURC to the service, and they immediately deliver traditional dollars or euros to your recipient's bank account. They handle the conversion, bridging the gap between both payment rails.