The End of the Checkout Button?

Visa's recent Global Product Drop unveiled more than a product suite; it signaled a strategic infrastructure play for the emerging agentic AI economy. The initiative, dubbed 'Intelligent Commerce,' should not be viewed as a mere feature update. Instead, it represents a foundational bid to build the transactional rails for a future dominated by AI-driven commerce. The core problem it addresses is the persistent, high-friction gap between consumer search and final purchase—the chasm where commercial intent is routinely lost.

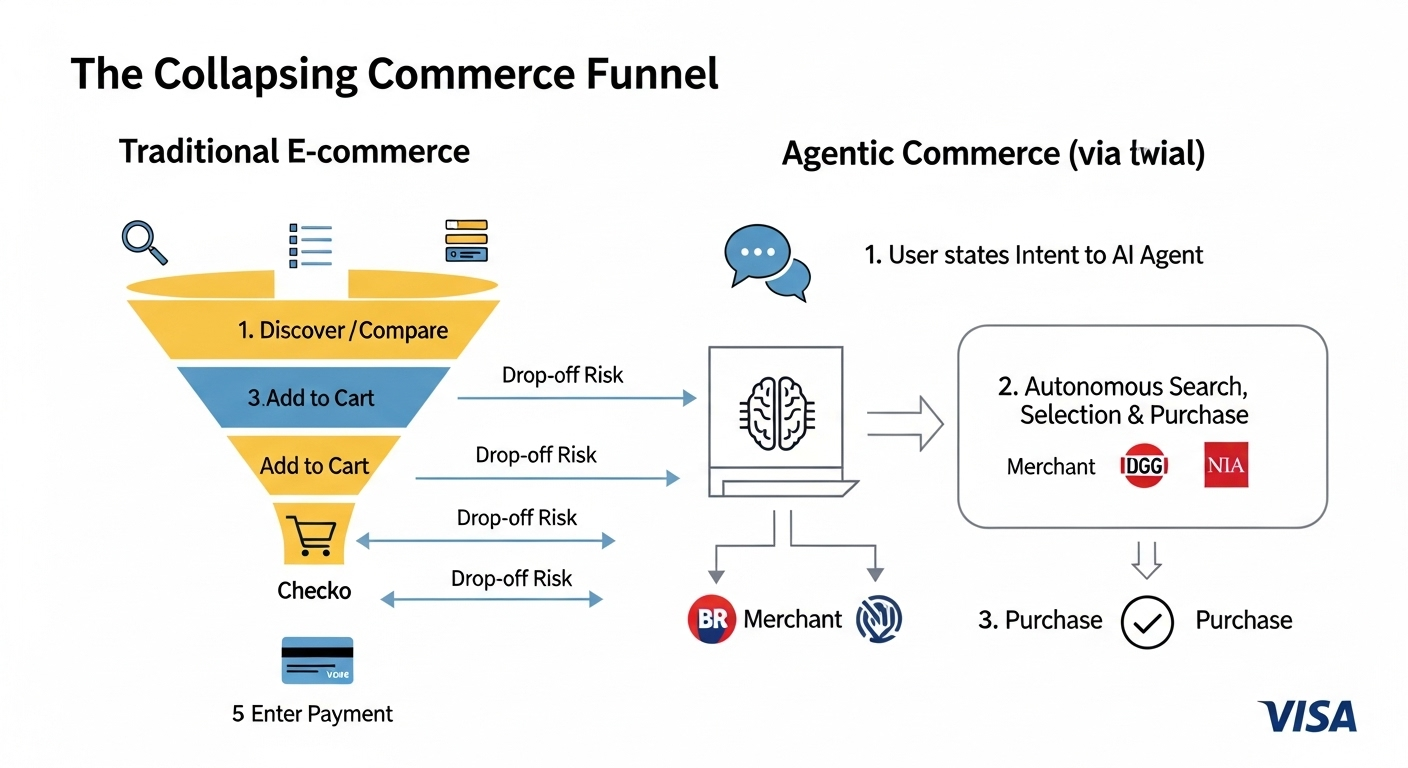

The central thesis is audacious: to collapse the traditional, multi-step e-commerce funnel into a single, intent-driven action. By leveraging generative AI to interpret complex user requests and autonomously execute secure transactions, Visa is positioning itself to own the critical moment of conversion. This move aims to fundamentally alter the architecture of online commerce, shifting the paradigm from a user navigating a series of pages to a user stating an intent that is instantly fulfilled. It's a direct play for the infrastructure layer of an internet where autonomous agents transact on behalf of users, making the distinction between discovery and purchase obsolete.

The Architecture of Autonomous Transactions

The mechanism begins with user onboarding via payment passkeys, a FIDO-based standard that securely links a payment credential to the user's device and biometrics. This process generates a device-bound payment token, effectively "seating" the credential inside the AI agent without exposing raw card data. This tokenized credential then interacts with Visa's infrastructure through five core API modules, which serve as the essential building blocks for autonomous commerce.

These modules are:

- Authentication: Verifies user identity before authorizing the agent to transact.

- Tokenization: Creates and manages the secure payment tokens used by the agent for each transaction.

- Payment Instructions: Provides the agent with flexible, pre-approved payment parameters, such as spending limits or approved merchant categories.

- Personalization: Leverages Visa's data assets to enable agents to find tailored offers and relevant purchasing opportunities.

- Signals: Delivers real-time data, including fraud scores from Visa Advanced Authorization, to inform secure transaction decisions.

Together, these modules form a secure, interoperable framework, allowing developers to build AI agents capable of executing trusted, autonomous purchases on a user's behalf.

Strategic Implications for the AI Economy

Visa's Intelligent Commerce initiative is less a product launch and more a strategic land grab for the future of the internet. By building the transactional rails for the agentic economy, Visa is establishing a formidable first-mover advantage. The goal, as articulated by Mark Nelsen, Senior Vice President at Visa, is to "close the gap between a consumer’s shopping intent and a final purchase," effectively eliminating the friction-filled chasm of the traditional e-commerce funnel.

For AI developers, this framework is a gateway to new monetization models. By integrating Visa’s secure APIs, they can move beyond informational assistants to create commercially-capable agents, unlocking revenue through affiliate fees or premium transactional features without the burden of building PCI-compliant infrastructure. This lowers the barrier to entry for creating truly autonomous services.

Merchants face a dual-edged sword. The promise of collapsing the purchase funnel and drastically reducing cart abandonment is immense. However, it necessitates a fundamental shift in marketing strategy. The new target is not a human consumer swayed by branding and UX, but an AI agent driven by logic and data. This heralds the rise of "Agent Engine Optimization" (AEO), where success depends on structured data, competitive pricing, and API-friendly product information, potentially eroding traditional brand loyalty in favor of algorithmic efficiency.

This shift places the consumer at a critical juncture between convenience and control. The prospect of an agent autonomously managing purchases raises valid privacy and oversight concerns. Visa’s strategic inclusion of the "Payment Instructions" module is the crucial answer to this dilemma. By allowing users to set explicit guardrails—spending limits, approved merchant categories, and other rules—it transforms the agent from a blank check into a trusted, rule-bound delegate. This feature is the linchpin for building consumer trust.

Ultimately, this is a power play within the payments industry. By providing the core infrastructure and getting developers to build on its platform, Visa is constructing a powerful competitive moat. It aims to become the default network for AI-driven commerce, embedding itself into the very logic of the next commercial paradigm. This positions Visa not just as a processor of transactions, but as the "Intel Inside" for an autonomous, agent-driven economy.

The Twin Pillars: Trust and Intelligence

The system’s viability rests on two pillars: security and personalization. Visa leverages its deep expertise in AI-driven fraud prevention, citing its model's prevention of $40 billion in fraud annually as a core trust signal for this new paradigm. The security architecture is not an afterthought; it's foundational. FIDO-based payment passkeys bind credentials to a user's device biometrically, while tokenization ensures the AI agent never handles raw card data. These measures create a secure, device-bound delegate, not an exposed credential.

This secure framework enables powerful personalization through consented data sharing. By analyzing a user's historical transaction data, the agent moves beyond generic, search-based recommendations. It gains the capacity for hyper-contextual purchasing, identifying opportunities and executing transactions based on nuanced, individual spending patterns. This transforms the agent from a simple tool into a sophisticated financial delegate, capable of anticipating needs and optimizing purchases with a level of precision previously unattainable. This data-driven tailoring is what unlocks the true potential of autonomous commerce.

Laying the Foundation for an Autonomous Future

Visa's Intelligent Commerce initiative is not merely another API suite; it is a strategic bid to build the foundational payment layer for the emerging agentic economy. By securely connecting AI agents to its vast global network through tokenization and passkeys, Visa is positioning itself to fundamentally redefine the digital purchase journey. The initiative collapses the traditional e-commerce funnel, replacing a series of clicks with a single, intent-driven command.

The most critical insight, however, lies in the structural shift this represents. We are moving away from a user-driven checkout process, defined by carts and buttons, toward a programmable, autonomous transaction model. In this new paradigm, commercial intent is instantly and securely converted into a completed purchase, making Visa the essential infrastructure for the next generation of commerce. This isn't about improving the checkout button; it's about making it obsolete.